monterey county property tax rate

The Monterey County Association of REALTORS promotes professionalism property rights and home ownership. Calculation of Taxes Page 5 Property Tax Highlights FY 2020-21 Once the Assessor has finalized the assessment roll it is provided to the Auditor-Controller on or before July 1st.

Calculation Of Property Taxes In The South Bay Palos Verdes Real Estate Agent Realtor Maureen Megowan

You will need your 12-digit ASMT number found on your tax bill to make payments by phone.

. Average Property Tax Rate in Monterey. Tax Rate Areas Monterey County 2022. Yes you can pay your property taxes by using a DebitCredit card.

Official Monterey County Flag Monterey County Ca Monterey Park Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Monterey Park California. The minimum combined 2022 sales tax rate for Monterey County California is. The 2018 United States Supreme Court decision in.

Find All The Record Information You Need Here. Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. Such As Deeds Liens Property Tax More.

The California state sales tax rate is currently. This is the total of state and county sales tax rates. Then who pays property taxes at closing when buying a house in Monterey County.

Real estate ownership shifts from the seller to the new owner at closing. Monterey County Building Inspector 168 West Alisal Street Salinas CA 93901 831-755-5025 Directions. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes.

Monterey County Transfer Taxes. Search Valuable Data On A Property. Almost all the sub-county entities have contracts for the county to bill and collect their tax.

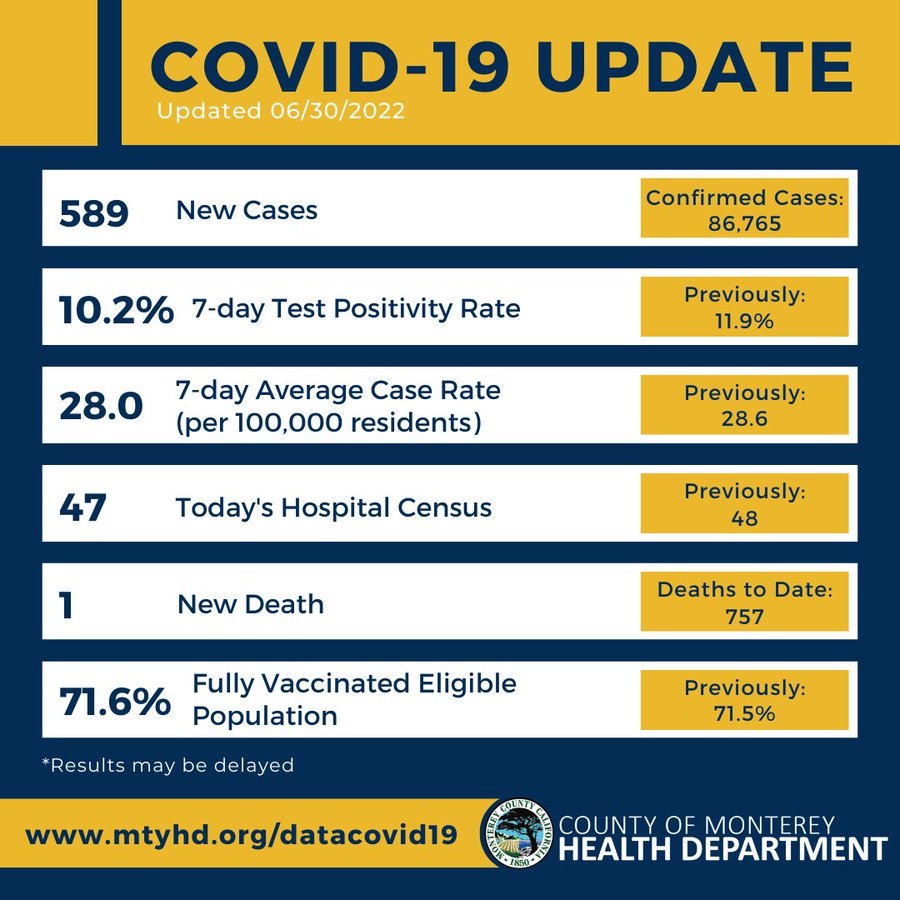

County Departments Operations During COVID-19. The median property tax on a 56630000 house is 594615 in the United States. An appraiser from the countys office determines your propertys market value.

Contact Us A-Z Services Jobs News Calendar. They are a valuable tool for the real estate industry offering both. The Monterey County sales tax rate is.

1-831-755-5057 - Monterey County Tax Collectors main telephone number. For E-Check a flat fee of 025 is charged. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Monterey County.

The median property tax on a 56630000 house is 419062 in California. What triggers a transfer tax. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per.

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Total tax rate Property tax. So if your home is valued at 1000000 the transfer tax would be 1100.

Choose Option 3 to pay taxes. As computed a composite tax rate times the market value total will provide the countys entire tax burden and include individual taxpayers share. Monterey Property Taxes Range.

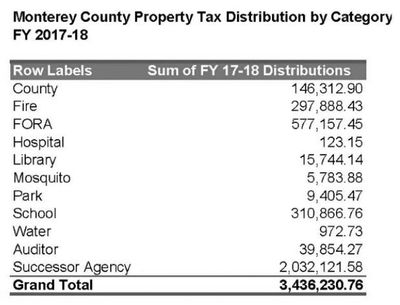

Information in all areas for Property Taxes. Based on latest data from the US Census Bureau. The Auditor-Controller then calculates the property taxes due by parcel and its assessed val-ue.

Normally whole-year property taxes are paid upfront a year in advance. A transfer tax is imposed on documents that show an interest in property from one person to another person. If Monterey property taxes have been too costly for your wallet causing delinquent property tax payments consider taking a quick property tax loan from lenders in Monterey TN to save your.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in revenue for the County public schools cities and districts. All major cards MasterCard American Express Visa and Discover are accepted.

Single Family Dwelling with GuestGranny Unit and Bath. 1-800-491-8003 - Direct line to ACI Payments Inc. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector.

Ad Unsure Of The Value Of Your Property. Get free info about property tax appraised values tax exemptions and more. At the same time responsibility for paying taxes goes with that ownership transfer.

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. General Law or Chartered Per 1000 Property Value City Rate Revenue. Enter the Address Here.

They are maintained by various government offices in Monterey County California State and at the Federal level. That updated value is then multiplied times a composite rate from all taxing entities. The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

Monterey Property Taxes Range. That means the state levies a transfer tax of 055 per every 500 of home value. Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property.

Each entity establishes its independent tax rate. Testing Locations and Information. The Monterey County Assessors Office located in Salinas California determines the value of all taxable property in Monterey County CA.

The Monterey County Sales Tax is collected by the merchant on all qualifying. Ad Get In-Depth Property Tax Data In Minutes. Start Your Homeowner Search Today.

For credit cards the fee is 225 of the total amount you are paying. A convenience fee is charged for paying with a CreditDebit card. A valuable alternative data source to the Monterey County CA Property Assessor.

The property tax rate used by the Auditor-Controller include.

California Public Records Public Records California Public

What Is A Homestead Exemption California Property Taxes

How To Calculate Property Tax And How To Estimate Property Taxes

Public Health Monterey County Ca

What Are The Advantages Of Investing In Real Estate Everyone Should Own At Least One House Or A Piece Of Real Estate Investing Real Estate Investor Investing

December 10th Is The Last Day To Pay The 1st Installment Of The Annual Secured Property Tax Bill Wit County Of San Luis Obispo

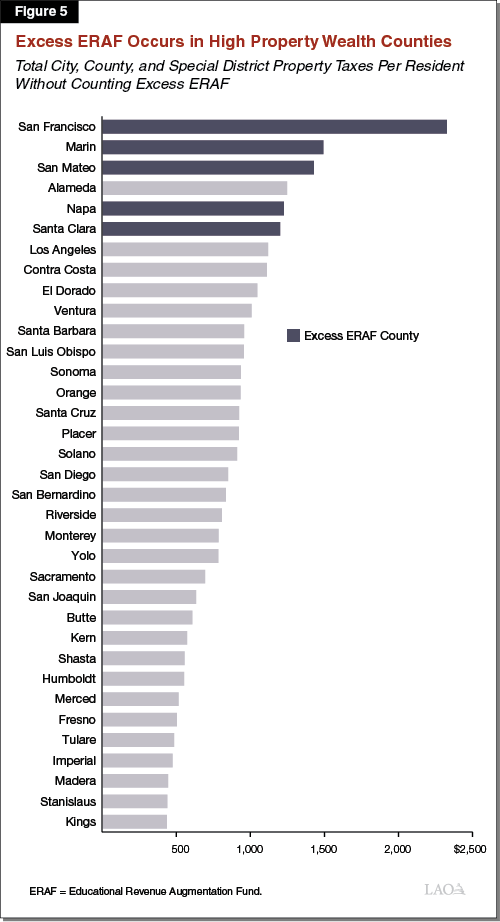

Excess Eraf A Review Of The Calculations Affecting School Funding

8377 State Road 259 Lost River Wv 26810 Mls Wvhd105262 Zillow Lost River Zillow Home Inspector

Croton On Hudson Police Are Warning Residents To Be Watchful For Coyotes Coyote African Wild Dog Wild Dogs

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

How To Calculate Your Tax Bill

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo